Governance

Corporate governance

Basic approach

Within the Nichiden Group, our basic approach to corporate governance is to facilitate swift managerial decision-making in response to changes in the business environment while also establishing corporate ethics, ensuring legal and regulatory compliance, and strengthening internal control systems for greater business efficiency. In terms of business transparency, we believe that timely disclosure of information to stakeholders is an important aspect of safe and sound management, and we strive to ensure our communications reflect that.

Overview of our corporate governance structure

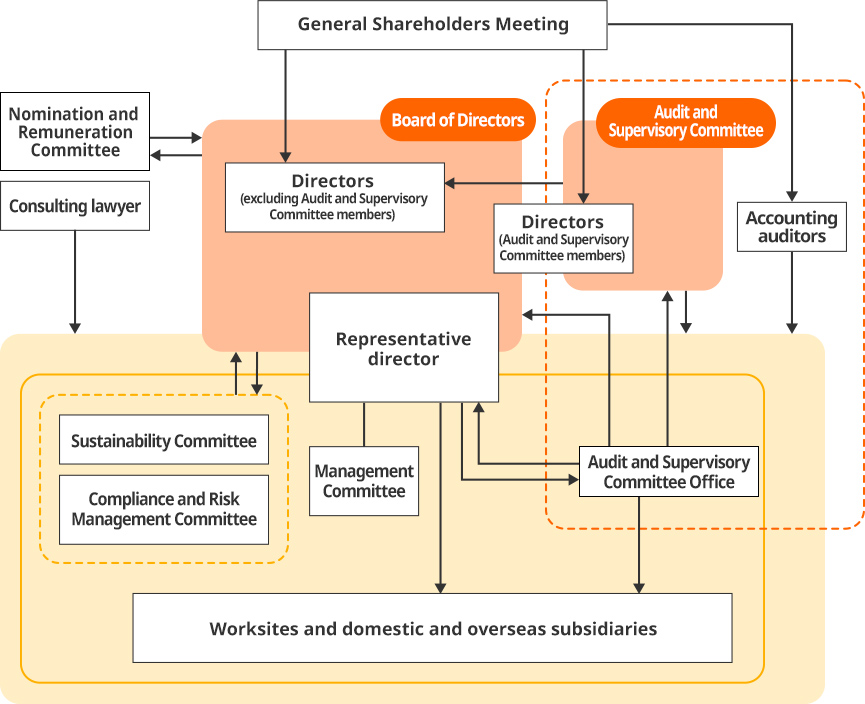

At Nichiden, we have in place an Audit and Supervisory Committee to enhance corporate governance through stronger Board of Directors oversight, as well as to facilitate faster decision-making and execution of business by ensuring clear delegation of authority, thereby improving business integrity and efficiency and, in turn, greater corporate value.

As a rule, Nichiden’s Board of Directors meets once a month to deliberate, vote, and report upon various matters as well as to provide oversight and make recommendations about the execution of business. Based on the policies adopted by the Board of Directors, regular and extraordinary meetings of the Management Committee and block committees are convened to help ensure that Nichiden is able to flexibly respond to changes in the business environment.

We’ve also created a Nomination and Remuneration Committee to serve as an advisory body to the Board of Directors.

Corporate governance structure

Board of Directors

The Board of Directors, which as a rule meets once a month, oversees decision-making on important matters and the execution of the company’s operations. The body consists of 9 directors, including three outside directors, to ensure it can exercise its oversight function effectively. It strives to respond in a dynamic manner to changes in the business environment through both regular monthly meetings and regular and extraordinary meetings of block committees and other groups.

Number of meetings in fiscal 2023: 10

Chair: President

Length of term for directors: 1 year

Audit and Supervisory Committee

The Audit and Supervisory Committee uses a variety of resources, including reports from accounting auditors and executive officers, to perform strict auditing of the legality and validity of executive officer job performance. In addition, as a rule and in line with the Committee’s auditing policies and auditing plan, the Audit and Supervisory Committee meets once a month to engage in opinion and information exchange with accounting auditors and members of the Audit and Supervisory Committee Office with regard to their ongoing on-site audits of organizational management system and operational procedure suitability and internal control propriety, endeavoring to improve auditing effectiveness and efficiency.

Number of meetings in fiscal 2023: 11

Composition: 4 Audit and Supervisory Committee members (of whom 3 are outside directors)

Chair: Inside director

Nomination and Remuneration Committee

The Nomination and Remuneration Committee develops structures to ensure fairness in the appointment, dismissal, and compensation of directors (excluding Audit and Supervisory Committee members). By making recommendations to the Board of Directors concerning topics including the appointment of officers and the determination of officers’ compensation programs and levels, the body brings greater transparency and fairness to those processes.

Number of meetings in fiscal 2023: 3

Composition: President and two outside directors

Chair: Outside director

Management Committee

The Management Committee, which is made up of inside directors and executive officers and chaired by the president, deliberates on which resolutions will be considered by the Board of Directors and discusses associated specific measures and issues. Findings are reported to all officers via block committees and to outside directors so that specific issues and problems affecting the company’s operations can be addressed in a timely manner.

Number of meetings in fiscal 2023: 9

Sustainability Committee (created June 2022)

The Sustainability Committee works to ensure the company operates in a sustainable manner by formulating a basic policy on sustainability, setting goals for resolving key issues (materiality), formulating action plans, managing and evaluating progress towards goals, and discussing individual policies. It also submits reports and recommendations to the Board of Directors and the Management Committee on a regular basis.

Number of meetings in fiscal 2023: 2

Compliance and Risk Management Committee

In order to ensure the effectiveness of our risk management, we’ve established a Compliance and Risk Management Committee, which is chaired by the president. It allows a comprehensive review of the company’s risk management-related policies and measures. In line with the risk management rules, the Committee has established risk-specific oversight departments, which regularly review Nichiden’s risk response measures. The Corporate Planning Department complies those reviews and reports them to the Board of Directors. In the event of unforeseen contingencies, the Committee takes timely action in accordance with internal rules to minimize damage and prevent a recurrence.

Number of meetings in fiscal 2023: 2

Strengthening corporate governance

Evaluating the effectiveness of the Board of Directors

We administer a questionnaire concerning the effectiveness of the Board of Directors to all directors once a year and solicit third-party views. The results of the questionnaire are analyzed and evaluated, reported to the Board, and discussed.

During the company’s 72nd fiscal year, the questionnaire addressed topics including the roles, functions, size, and composition of the Board, the manner in which it operates, how it collaborates with audit bodies, its communication with the company’s management, and its relationship with shareholders and investors. Topics discussed in light of the results included enhancing discussions of medium- and long-term management issues, including succession plans; enriching reports to the Board concerning shareholders and investors; and enhancing opportunities for providing information to outside directors. An analysis and evaluation based on the results of those discussions concluded that the Board fosters free and unfettered discussions, fulfills its roles and expectations in an appropriate manner, and functions in a sufficiently effective way.

During the 73rd fiscal year, we plan to administer a questionnaire that addresses topics including the roles, functions, size, and composition of the Board, the manner in which it operates, how it collaborates with audit bodies, its communication with the company’s management, and its relationship with shareholders and investors.

Executive appointment/dismissal and director/auditor nomination policies

Candidates for director positions (excluding Audit and Supervisory Committee members) from both inside and outside the company who possess the following qualities and are capable of carrying out the duties of a manager are nominated by the Board of Directors based on their experience, knowledge, and performance following an advisory and reporting process involving the Nomination and Remuneration Committee.

Appointment policy

- (1) Candidates must have extensive job experience and exhibit deep specialization in a specific field.

- (2) Candidates must have an excellent sense of management and be capable of contributing to the development of business strategies and policies on a companywide basis.

- (3) Candidates must possess fundamental knowledge about management and administration.

- (4) Candidates must exhibit character, judgment, and education befitting an officer of the company.

Dismissals of directors (excluding Audit and Supervisory Committee members) are handled as appropriate in light of Nichiden’s performance and the environment in which it operates. In the event a director fails to satisfy the conditions of appointment as described above, the Board of Directors will discuss dismissal and place it on the agenda of the General Shareholders Meeting following an advisory and reporting process involving the Nomination and Remuneration Committee. We’ve also put in place additional objective and transparent procedures by allowing the Audit and Supervisory Committee to effectively utilize its right to express its views on the appointment and dismissal of directors to the Board.

Candidates for director positions (Audit and Supervisory Committee members) who are deemed capable of carrying out the duties and fulfilling the responsibilities of Audit and Supervisory Committee member and contributing to the establishment of fair management oversight structures after a careful consideration of their individual personalities, knowledge, and other qualities are nominated by the Board after the agreement of the Audit and Supervisory Committee has been obtained.

Skills matrix of directors

| Name | Gender | Rank and area of responsibility | Corporate management | Sales and marketing | Finance and accounting | Human resource management | Compliance and risk management | |

|---|---|---|---|---|---|---|---|---|

| Toshikazu Fuke | Male | Representative director and president executive officer |

Nomination and Remuneration Committee | 〇 | 〇 | 〇 | ||

| Kenichi Okamoto | Male | Representative director and senior managing executive officer |

Head of sales | 〇 | 〇 | |||

| Atsushi Sangawa | Male | Director and managing executive officer |

Administration Department general manager |

〇 | 〇 | 〇 | ||

| Jyunji Morita | Male | Director and managing executive officer |

Business Promotion Department general manager |

〇 | ||||

| Hajime Sasaki | Male | Director and senior executive officer |

West Block general manager | 〇 | ||||

| Yasuo Higaki | Male | Director | Full-time Audit and Supervisory Committee member |

〇 | 〇 | |||

| Kiyokazu Furuta | Male | Outside director | Audit and Supervisory Committee member Nomination and Remuneration Committee member |

〇 | ||||

| Masaru Kawakami | Male | Outside director | Audit and Supervisory Committee member Nomination and Remuneration Committee chair |

〇 | ||||

| Yasuko Terashima | Female | Outside director | Audit and Supervisory Committee member | 〇 | ||||

※You can view it by scrolling horizontally.

Internal Control

The Nichiden Group recognizes that putting in place and administering structures to ensure proper operations (i.e., internal control systems) in keeping with its management philosophy are important responsibilities of management and critical preconditions for fulfilling its social responsibility and increasing its corporate value. Consequently, we’ve put in place an internal control system as described below in accordance with Japan’s Companies Act and the Companies Act Enforcement Ordinance. In addition, the Group will continue to develop and administer even more appropriate internal control systems in the future as its internal and external environments change.

Internal audits

Internal audits are carried out by the Audit and Supervisory Committee Office in accordance with internal audit rules.

The Audit and Supervisory Committee fosters collaboration with accounting auditors by communicating with them about risk and audit items when formulating audit plans; receiving reports on the status of audits, for example at audit report sessions held during audits and reviews at the end of each accounting period; and exchanging views on and studying important accounting-related topics.

Matters related to internal control systems: Refer to the Corporate Governance Report.

Cross-shareholding

Each year, the Board of Directors examines whether the benefits and risks associated with cross-shareholding are appropriate in light of associated capital costs after taking into account the nature of each company’s dealings with Nichiden and dividend yields and then determines whether to continue holding the shares in question. Our policy is to curtail holdings of shares if we determine that the benefits of the arrangement are not appropriate in light of capital costs following an examination of our relationship with the counterparty and other factors.